About Company

Investment and International Financing

Betcoinfit Financial Services, an investment consulting company headquartered in the city of Sao Paulo, successfully serves large public and private customers in many countries around the world. Our leading experts have more than 20 years of experience in the international financial market.

We provide reliable financing for projects using the most realistic schemes and models for various sectors of the economy.

Betcoinfit Financial Services is ready to offer any necessary investment for your project.

The knowledge of our asset managers and economists will satisfy even the most demanding customer. Experienced specialists and partners with an impeccable reputation help our clients achieve their goals, implement large infrastructure, industrial and energy projects virtually anywhere in the world.

Our services:

Investment financing.

Project finance.

Long-term lending.

Investment consulting.

Financial modeling.

Letters of credit and bank guarantees.

International engineering.

Also, our company provides financial instruments widely used in international practice: Standby Letter of Credit (SBLC), Bank Guarantee (BG), Documentary Letter of Credit (LC / DLC), etc.

With extensive experience, understanding of the financial issues of modern business issues and access to the latest European technologies, the Link Bridge Financial LTDA LBFL team is able to provide comprehensive, high quality services to each customer.

The services of our experts are available in Europe and the USA, in Latin America and Asia, the Middle East and Australia.

We offer financing and assist in the implementation of:

Solar PV plants and CSP projects.

HPP and wind power plants.

Gas and coal thermal power plants.

Electric substations of all types.

LNG plants and regasification terminals.

Mining and processing plants.

Mineral fertiliser plants.

Seaports and port infrastructure.

Waste processing plants.

Water treatment facilities.

Infrastructure facilities.

Shopping and residential complexes.

Cement factories, etc.

Our values:

Main priority. Customer first. We provide comprehensive expert support to each of our clients.

One team. The company’s most valuable asset is our employees. We take care of them and their families.

Reputation. Honesty and openness. We are always attentive to the smallest details that we discuss with clients.

Open borders. International cooperation and partnership. We are open to solving your problems in any country in the world.

Thinking about the future. Digital technologies. Advances in technology open up even more opportunities for our customers.

Our experts offer solutions in which they are completely confident.

We cooperate with leading engineering and construction companies in Spain, Europe and other countries of the world. The range of their technical services is extremely wide and includes: solar panels and solar concentrators, gas and wind turbines, advanced energy storage systems and desalination plants, innovative recycling plants and much more.

Reliable partner support in many countries of the world allows us to offer top-class investment and engineering solutions in a reasonable time and on favorable terms.

Contact us to learn more.

Financing of Investment Projects and Businesses

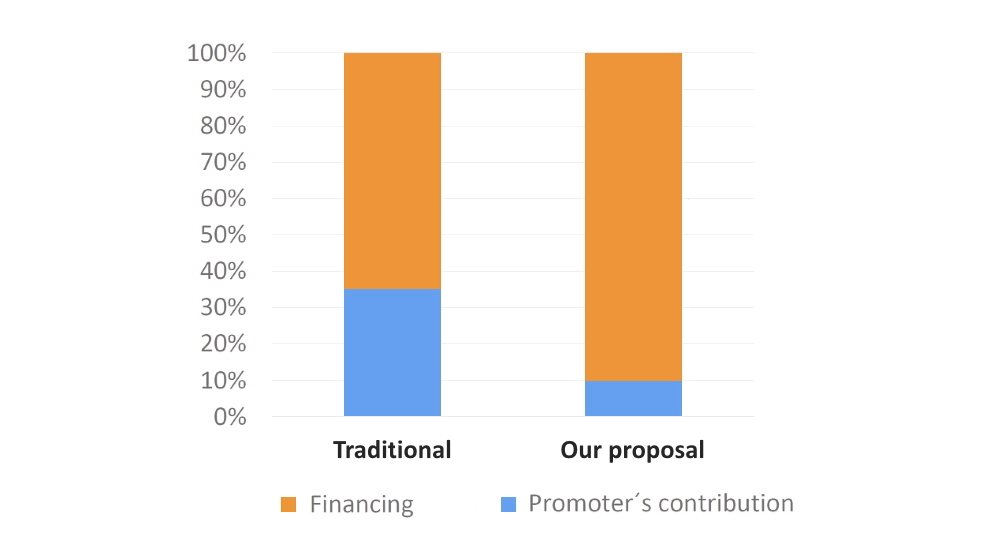

1. Betcoinfit Financial ervices offers financing with a minimum contribution of the Project Initiator (Promoter) for any industries: energy, mining, chemical wastes, industrial, agriculture, machinery, infrastructure, logistics, real estate, tourism etc.

Proposed funding: from $ /€ 5 million or equivalent and more.

Loan duration: from 10 to 20 years.

To consider Your application, please provide us with a brief description of Your investment or business project, fill out the form and send it to us by e-mail (download the application form).

Please note: if the client does not have liquid assets, the application will not be processed.

We employ top-level professionals and asset managers who study every specific case providing a financial solution that allows the Promoter to finance the project in the long term with the minimum possible contribution.

Equity is replaced by guaranteed financing.

2. Contribution of the Promoter (Initiator) to the Project prior to obtaining a building permit.

In all cases, the Promoter must cover the running costs prior to obtaining a construction permit. These costs will be considered the contribution of the Promoter to the Project. The cost of land or obtaining rights to it is also paid by the Promoter.

It is supposed to study which option is most convenient for the Promoter in each case.

3. A flexible combination of Bank Financing and contributions from Financial Investors is proposed for the period of construction and at least 15 years of operation of the facility, replacing the traditional Project Financing.

SPV will be created only for the construction of the project in which the loan guarantor will have a majority stake only during the construction period. The necessary credit will be insured by external guarantees in such a way that the Promoter´s Bank will have no problem in financing the construction.

At the end of the Construction the Assets will be acquired by an Investor who will receive an annual income for at least 15 years, giving the option to buy back the Asset to the Operating Company. The future annual income of the Investor must have a guarantee from the Operator´s Bank.

4. Procedure to carry out until the operation of the business.

An exclusive collaboration agreement will be signed between the Initiator (Promoter) and our company jointly with the advisory financing and investment structuring company proposed by us. In this agreement all the steps and conditions necessary to obtain the financing are foreseen:

Advice on hiring of the

construction company.

Obtaining a conditional offer from the Bank to finance the construction of the project.

Obtaining a conditional offer from the Bank to ensure the future annual income of the Financial Investor for the exploitation period.

Obtaining a non-binding offer from the Financial Investor.

Preparation of the final Business feasibility study.

Obtaining the Credit Guarantees and financing for construction.

Obtaining the Financial Investor for the exploitation period of the business.

Agreement for the establishment and management of a SPV in charge of financing and carrying out the construction of the project.

Advice the agreement between the Promoter, business Operator and the Financial Investor for the exploitation period.

Advice for the use of international legal and commercial instruments until start of business operation.

All the financial and structuring costs will be included in the Project financing budget and deducted from the financing granted.

Contact us for more information.

Long-term Business Lending

Betcoinfit Financial Services is an international company providing a wide range of financial and consulting services for the private and public sectors of the economy in many countries around the world.

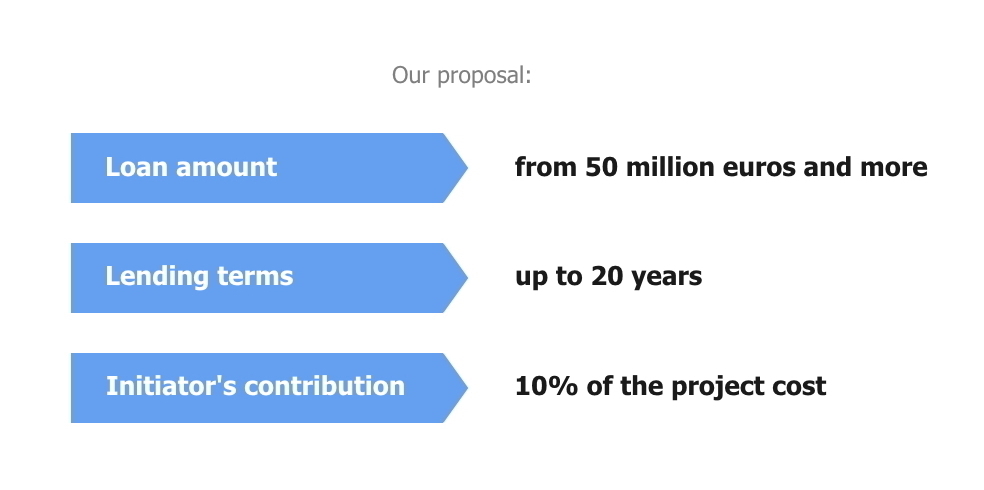

We offer long-term loans from $ /€ 5 million or equivalent with flexible repayment terms for a maximum period of 20 years, tailored to the financial flows of the specific business or investment project.

We are experts in business financing, which is why we guarantee quick and effective adjustment of loan conditions to your expectations and needs.

BFS offers its services to companies promoting long-term projects in energy, heavy industry, infrastructure, agriculture, real estate, tourism and other sectors.

Our company offers loans for the following investment projects:

Large energy facilities: solar farms, wind farms, thermal power plants of all types, hydroelectric power plants, electrical substations, etc.

Oil and gas projects: liquefied natural gas plants, LNG regasification terminals, refineries, compressor stations for gas pipelines, etc.

Extraction and processing of raw materials: mining and processing plants, mines, quarries, fertilizer plants, chemical plants, metallurgical plants, etc.

Infrastructure projects: seaports and container terminals, housing complexs, roads and railroads.

Environmental projects: waste treatment plants, chemical waste treatment systems, water treatment facilities.

A professional team of financial advisors, analysts and asset managers thoroughly investigates each client’s background and selects the best financing option for a particular project. Our extensive experience, cutting-edge financial engineering solutions and worldwide business contacts enable BFS to provide competitive loans with an initial down payment of up to 10% of the project cost.

Our clients have access to flexible long-term bank financing for large projects. Our innovative schemes successfully replace project finance, expanding opportunities for your business.

Large long-term loan BFS services are aimed at large companies with ambitious capital-intensive projects anywhere in the world. BFS offers long-term loans to clients in all sectors and types. We offer money to firms that have been in the market for decades, as well as start-ups and newly established companies. The main prerequisites for a large loan are adequate collateral and a sound business plan or investment project.

Business development

The purpose must be closely related to the activities to be performed.

Thanks to the years of experience of our finance team, BFS is able to guarantee a professional, fast and efficient transaction. We have worked with dozens of clients who have obtained long-term loans for various purposes.

The advantage of working with BFS is also fast loan processing and attraction of significant investments, depending on the needs of your project.

Contact us at any time to learn more.

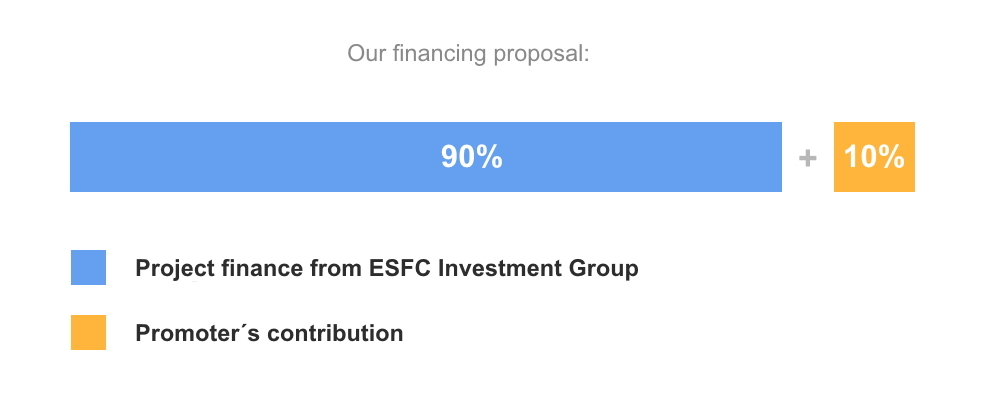

Lending up to 90% of the Project Cost

Betcoinfit Financial Services is a reliable financial partner, ready to offer clients project financing in the form of a flexible long-term loan, taking into account previously incurred expenses.

Our financial instruments provide financing for up to 90% of investment costs with a maturity of up to 20 years.

The financing model we offer may include investment costs previously incurred by customers.

Example of 90% funding:

• The total cost of the investment project is €100 million.

• About €10 million has already been spent on the project.

• The Project Initiator can apply for a loan of €90 million.

If the Project Initiator has no assets (for example, land, money, buildings, etc.) application are not considered.

The minimum loan amount is $ /€ 5 million or equivalent, with no maximum limit.

Big business owners plan for decades to come, but in the modern world, the financial health of companies can change drastically in a matter of days, despite “reliable” forecasts or studies. Financial crises, pandemics, tensions between countries and funding freezes are becoming important factors that businesses need to consider.

Why companies may need additional funding:

Construction risk.

Typically, the source of debt repayment in project finance schemes is the cash flow generated by the future object. Any violation of construction plans can lead to certain financial problems requiring additional funds. Operational risk.

Violation of the operation and maintenance of the facility as a result of contractor errors or other factors is associated with a serious financial risk.

Supply risk.

Many projects depend on a continuous supply of materials, fuels and other resources. If the volume of supplies or the cost of resources have changed, we are ready to help.

Economic risk.

Slowdown of the national and world economy, lockdown, changes in market conditions and exchange rates are reflected in the prospects of the investment project.

Political risk.

Developing countries are especially sensitive to geopolitical shocks. Risks such as nationalization and expropriation of property, sanctions, military conflicts, business restrictions and unstable legislation can affect the financial health of companies. Practice shows that underfunding of investment projects is closely related to factors such as improper planning and assessment of investment needs and the use of multiple sources of funds.

Our company is ready to provide flexible loans that compensate for up to 90% of the investment costs incurred by the Project Initiator.

We finance investment projects in the energy, infrastructure, industry, agriculture, mining and processing of minerals, oil and gas sector, chemical waste processing, real estate and tourism.

Contact us to find more.

Refinancing for Businesses and Enterprises

The international company Betcoinfit Financial Services offers corporate refinancing services using long-term loans on attractive terms and other flexible instruments. In an era of global changes, every entrepreneur strives to use new opportunities for business development as quickly as possible.

Refinancing a business loan helps you achieve success by making borrowed funds more efficient.

Sharp fluctuations in raw materials and energy prices, geopolitical instability and other unpredictable factors have a negative impact on many enterprises. In these conditions, high interest rates and monthly loan payments can become a heavy burden for business, slowing down the development of the company for many years.

Betcoinfit Financial Services, a investment consulting company with an international presence, is ready to offer you flexible corporate refinancing schemes. In particular, we can extend the term of your business loan in order to significantly reduce payments and overcome temporary problems.

Corporate refinancing is a service that gives companies access to more flexible loans.

This is a lifesaving option used by thousands of entrepreneurs around the world today.

We will ensure that your current business loan is repaid without negatively impacting the company’s liquidity.

We are ready to offer a variety of solutions to suit your company’s needs. From lines of credit or short-term loans for day-to-day activities to long-term loans for large projects and business refinancing.

Refinancing large business loans

Company debts can include old loans, unpaid taxes, and bills. If your business is experiencing temporary financial problems but the outlook is still promising, then corporate refinancing may be the perfect solution.

Debt refinancing consists of repaying one or more loans and replacing them with more flexible financing provided by new lenders. Within the framework of the enterprise refinancing program, it is also possible to attract significant additional funds on more favorable terms.

Sources of refinancing a company’s debt in the financial market may include the following:

• Bank loan.

• Corporate bonds.

• Mezzanine financing instruments.

• Factoring of receivables and reverse factoring.

• Raising funds from investors interested in the company’s shares.

Consolidate all payments into one cheaper loan and focus on core business activities. Our financial specialists will take care of all the formalities and suggest the most suitable solutions for each case.

Schedule a preliminary consultation at a convenient time so that we can study the current financial problems and needs of your company.

The business benefits of our services include:

• Assistance in paying off current and overdue debts. .

• Consolidation of all available loans into one, cheaper loan.

• Tailoring financing to the needs of your business.

• Support from experienced financial advisors.

LBFL works with major European banks, financial institutions and private investors, offering business financing in the EU, USA, Latin America, East Asia, the Middle East and North Africa.

Our experts will develop alternative tools for you, providing comprehensive support at all stages of refinancing.

Technological Superiority and Financial Stability

Today’s highly competitive market requires innovative solutions that are becoming increasingly important for the growth of the global economy and solving the problems of business and society as a whole.

Betcoinfit Financial Services strives to introduce new technologies in every project, thereby contributing to the achievement of investment goals and enhancement of clients’ reputation.

For our team, innovation is associated with such cutting-edge concepts as project finance, artificial intelligence, industry 4.0 and automation. These new global trends are dominating the economy, changing businesses and customers.

In order to ensure the highest level of our financial and consulting services, we support scientific research and work closely with leading scientific institutions both in Spain and in other countries of the world.

BFS’s innovative offerings include:

• Funding with a minimum contribution of the initiator.

• Combined schemes for long-term project financing.

• Realistic and efficient investment models.

• Innovations in chemical waste disposal and energy storage.

• Automated production control systems.

• Logistics solutions and much more.

Providing services in the field of international engineering, we, together with respected European partners, recognize the importance of R&D and flexible financial instruments for big business.

We care about achieving maximum efficiency and reliability of industrial, energy, agricultural, environmental and infrastructure projects.

Latest Projects:

Industry

Cement plant (Cement Factory) in Central Asia. The project is under development.

Energy

Solar photovoltaic (PhotoVoltaic) station in Latin America. The project was completed in 2021.

Ecology

Waste recycling plant (Waste Processing) in Western Europe. The project was successfully completed.

Energy

Gas turbine power plant (GTPP) in Latin America. The project was successfully completed.

Energy

Thermal power plant (TPP) in Western Europe. The project was completed in 2020.

Shipping

Seaport and equipment in the Middle East. The project was completed in 2019.

Energy

Solar PV power plant (PhotoVoltaic) in Latin America. The project was successfully completed.

Reliable partner support in many countries of the world allows us to offer investment and engineering solutions of the highest class within a reasonable time frame on attractive terms.

Our services:

• Investment lending.

• Financing projects.

• Financial modeling.

• Investment consulting. • Credit guarantees.

• Engineering.

Questions and Answers

What are the main directions of our activity?

What are the minimum and maximum amounts of loan?

In which countries we work?

How qualified are our specialists?

Is there a guarantee for equipment and work performed?

How to order a service? Didn’t find an answer to your question?

Contact us and we will provide the necessary information.

Ask a Question About Company Investment Project Financing

Didn’t find an answer to your question? Contact us and we will provide the necessary information. Ask a Question – https://linkbridgefinancialltda.com/en/company/faq/index.html