Financing and Engineering

LNG plant financial model

Betcoinfit Financial Services BFS offers a full range of services for large projects, including long-term lending and financial modeling for liquefied natural gas plants.

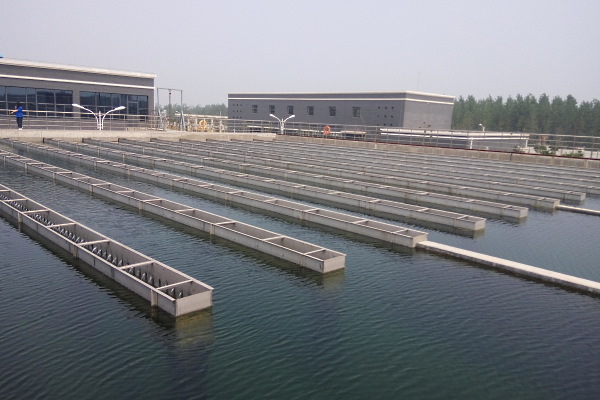

Financial model of water treatment plant

Increasing competition for capital highlights the important role of the financial model in the construction of water treatment plants.

Financial model of a mineral fertilizer plant -

The role of financial modeling services in the mineral fertilizer industry is steadily growing as competition for capital and global markets increases.

Financial model of a mining and processing plant

A high-quality financial model of a mining and processing plant is an important condition for attracting long-term project financing on favorable terms.

Financial model of a chemical plantl

A high-quality financial model of a chemical plant lays a solid foundation for attracting capital, smooth financing and commercial success of the future project.

Financial model for a hydroelectric power plant

The development of a financial model for a hydroelectric power plant (HPP) plays an important role in obtaining financing for large projects and contributes to the growth of the renewable energy sector.

Financial model of the solar energy project

A well-chosen financial model of the solar power plant lays the foundation for the success of the energy project, guaranteeing adequate funding on favorable terms.l

Mining and processing plant design

BFS, an international company, offers financing and engineering design for mining and processing plants under an EPC contract, including research, development of individual technical solutions, etc.

Chemical plant construction

BFS provides a full range of services for chemical companies, including construction of chemical plants and financing of large investment projects.

Financial model for a hydroelectric power plant

The development of a financial model for a hydroelectric power plant (HPP) plays an important role in obtaining financing for large projects and contributes to the growth of the renewable energy sector.

We offer project finance and investments: from $ /€ 5 million or equivalent with a loan duration up to 20 years

The construction of large hydropower plants is becoming an increasingly complex and costly task amid dwindling water resources and tightening environmental standards around the world.

The use of advanced financial models of hydroelectric power plants in the planning of investment projects is now becoming of great importance for business. Having high quality financial forecasts can be a key success factor that will push partners to invest in your multi-million dollar project.

The financial model is an important tool that opens the door to external financing in modern capital markets.

Betcoinfit Financial Services offers private and public customers professional assistance in financing energy projects around the globe, including long-term bank loans and project finance schemes.

We also develop tailor-made financial solutions for energy sector and other capital intensive areas.

Long-term hydropower plant financial model:

theoretical basis In corporate finance practice, the term “financial model” refers to a comprehensive analytical tool that is used to evaluate and compare projects. This tool is based on initial project data with a set of assumptions that are processed using standard mathematical and statistical methods to obtain the most accurate predictions of future results.

Financial modeling principles include the following:

• Taking into account all significant aspects of the hydropower project and all future events.

• The analysis period should cover the years over which the values of the variables can be predicted with reasonable accuracy.

• The long-term financial model of the hydropower plant should help to generate financial statements (income statement, balance sheet).

• The model must be dynamic, which means that important financial variables can be changed with a corresponding recalculation of the results.

• Revenues and costs for a single project should be modeled separately for each activity. • The model should take into account the trends observed in real-world projects. Since the construction of hydropower plants currently requires significant investments (in most cases, at least 2 million euros for 1 MW of installed capacity, taking into account the construction of reservoirs and environmental costs), the role of a high-quality financial model of hydropower plant in the long term can hardly be overestimated. Most often, such models should cover an investment period of at least 5-7 years.

The stages of forecasting the financial results of the HPP project include:

• Making a set of assumptions for financial analysis.

• Development of a detailed program to maximize profit (electricity sales).

• Forecasting revenues from electricity sales taking into account internal and external factors. • Forecasting the costs of production and supply / sale of electricity.

• Drawing up a project budget with a plan of expenditures and sources of funds. • Planning financial costs, taking into account the schedules of loan repayment.

• Drawing up a detailed report on the profit and loss of the project.

• Planning for working capital requirements.

• Drawing up detailed reports on cash flows.

• Determination of the cost of capital.

• Assessment of the effectiveness of the project.

• Risk analysis.

In practice, compiling a financial model for a hydroelectric power plant will require the collection and processing of a large amount of information that is relevant to the future and therefore subject to uncertainty. This activity requires complex calculations, taking into account changes caused by objective reasons or a change in the position of the project participants on specific issues. Thus, the level of qualifications, practical experience and technical equipment of the financial team, along with access to project information, determine the result of financial modeling of each project. Analysis of the financial needs of the hydropower project To assess the financial viability of a hydroelectric project, a holistic model can be proposed that reflects the structure of revenues and costs for a given type of project in the light of current regulations and market conditions (any significant aspects related to the commercialization of generated energy are important).

Assessment of HPP assets is the foundation for subsequent analyzes, because initially it is very important for companies to clearly establish the value that certain investments will add to achieve strategic goals. For this purpose, financial experts use different methods, depending on the specific type of asset and the use of unreliable data that can distort the results and create unnecessary risks. Currently, a number of economic methods are used to evaluate investment projects for hydropower plants, which can be classified as follows:

• Comparative analysis of projects, which includes an assessment of the cost of a specific project with the assets of competitive projects with similar parameters.

• Valuation of the project using real options, which is most applicable to hydropower projects. This approach provides some flexibility in the future and is based on predicting value in accordance with cash flows that depend on the occurrence of certain events.

• The discounted cash flow method, which evaluates assets (projects) based on an analysis of future cash flows, and then allocates them at an appropriate rate according to the risks of specific flows. For this type of project, it is necessary to determine the optimal financing scenario in advance. Since the accuracy of the financial model of a hydroelectric power plant is dependent on the accuracy of the data, a professional approach is essential to success.